The inception of great brands starts with a spark—an idea that solves a problem, fulfills a need, or disrupts an industry. But a high percentage of these brands launch with bold ambitions, clear differentiation, unique positioning, and a compelling reason for consumers to choose them. However, over time, many of these brands gradually lose their edge. They chase trends, mimic competitors, and rely on fleeting advantages like ingredients or benefits that can easily be copied.

The result? A battle of price wars, lost differentiation, and ultimately, irrelevance.

Building a lasting brand requires more than just a good product. You need a distinct brand that is impossible to replicate in the consumer’s mind, logically and emotionally. Most brands fail in this area, but the smartest ones find true differentiation through innovation, positioning, and design.

Nice Package

Don’t miss out on our monthly newsletter Nice Package!

Each month, we deliver a data-driven newsletter directly to your inbox, unpacking a critical topic in the FMCG & CPG industry.

"*" indicates required fields

Why “me too” brands fail.

Let’s examine a real industry challenge. Vega pioneered plant-based protein before it became a mainstream category. Their strong positioning and commitment to clean, performance-driven nutrition helped define the space.

However, as plant-based protein gained popularity, the market became saturated with competitors offering similar formulations. The category shifted, leading to increased competition and price-driven battles, making differentiation more difficult.

This pattern repeats across industries. Many brands started strong but lost their identity when competitors caught up. So how do brands prevent this from happening?

Innovation beyond the product.

Most brands assume innovation means launching new products or features. But real innovation starts with understanding your consumer better than anyone else. It means identifying their unmet needs before your competitors do.

Today, 82% of consumers make purchases with purpose in mind. They want brands that align with their values, solve a real problem, and stand for something beyond function. RXBar didn’t win because of an ingredient or a trendy health claim; it won because of radical transparency.

At a time when protein bars had confusing ingredient lists, RXBar boldly displayed its core ingredients—dates, egg whites, and nuts—directly on the front of the package. This wasn’t just a design choice but an innovation in brand communication. And it worked. The lesson? Innovation isn’t just about what you sell but how you position it.

What’s particularly compelling is how this approach aligns with consumer behavior patterns. While a large share of shopping may occur on mobile devices, brand recognition and trust are still predominantly built through physical retail encounters. The strongest omnichannel performers understand this dynamic, ensuring their packaging creates strong shelf blocking and visibility in store while maintaining effectiveness when translated to digital thumbnails and hero images.

Positioning the head vs. the heart.

Most brands get their positioning wrong by relying too much on the “head” and not enough on the “heart.” Head-based positioning is about logic: ingredients, features, and benefits. It’s easy to communicate but also easy to copy. Heart-based positioning is about emotion, which includes identity, aspirations, and belonging. It’s harder to execute and much harder to replicate.

Brands that focus only on the head are knocked off. But winning brands hammer their emotional connection into every aspect of their identity.

A 2022 Harvard Business Review study found that well-differentiated brands could retain up to 75% of their customers compared to the industry average of 48%. That’s because emotional differentiation creates loyalty—when consumers feel something about a brand, they stay.

Design ownable, distinct, and unmistakable.

CLIO entered the yogurt category with a simple but bold innovation—yogurt in the form of a chocolate-covered bar. But it wasn’t just the product that set CLIO apart—it was how they told the story visually. Their branding and packaging felt more like a decadent treat than a healthy snack.

The result? A brand that didn’t just compete—it owned a unique space in consumers’ minds. A brand’s look and feel should be as much a part of its differentiation as its product. If your brand looks like your competitors, you’re already losing. Consistency must be applied across all touchpoints. A consistent brand presence across all channels results in a 23% increase in revenue.

How to reposition when a brand gets too close to competitors.

If a brand realizes it is blending into the competitive landscape, the first step is to reevaluate its consumer insight.

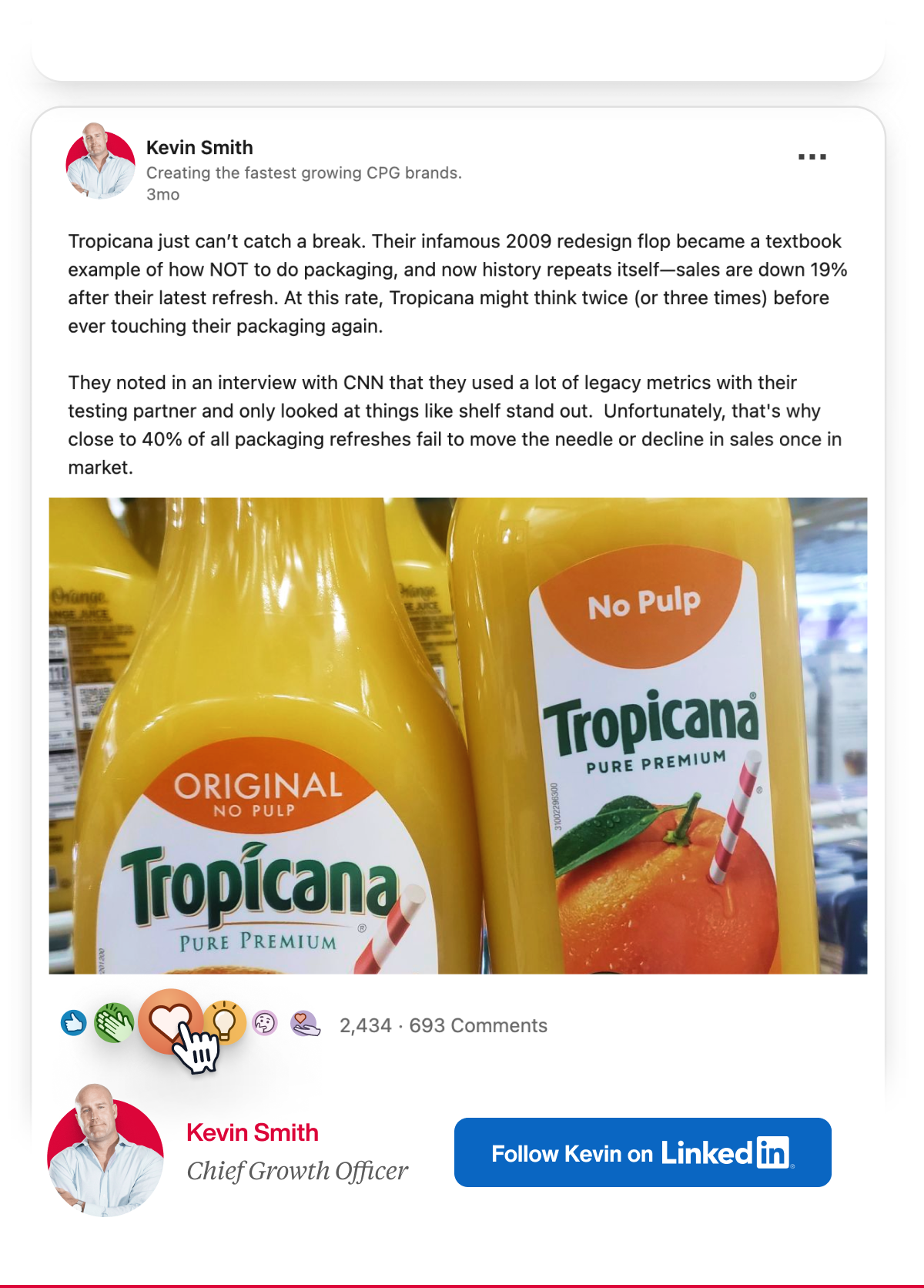

Many brands make the mistake of going too far when they reposition. They abandon their core strength rather than refining and reinforcing it. A great example is Tropicana’s 2009 packaging redesign. The brand attempted to modernize its look, stripping away its iconic orange-with-a-straw imagery and favoring a sleeker, minimalist design.

The result? Consumers no longer recognized it. Sales plummeted by 20% in just two months, forcing Tropicana to revert to its original branding.

Sadly, Tropicana appears to not have learned its lesson, repeating a similar mistake towards the end of 2024.

The lesson? Repositioning should enhance clarity, not create confusion. A brand’s evolution should feel natural to its audience—not like a sudden identity crisis.

How challenger brands compete without copying.

The biggest mistake challenger brands make is mirroring the strategies of category leaders. Instead of trying to be a better version of the dominant brand, challengers should find the blind spot that the leader isn’t addressing.

Today, 84% of customers consider a company’s experience as important as its products or services. This means challenger brands can’t just copy their competitors’ products—they need to craft a unique customer experience that strengthens loyalty and differentiation.

Future-proof your brand.

To avoid the “me too” trap, brands must future-proof their differentiation. Here’s how:

If your brand starts feeling too close to competitors, it’s not too late to fix it. But waiting is a risk you can’t afford. And here’s the good news: You don’t have to figure this out alone.

At SmashBrand, we specialize in turning “me too” brands into market leaders. Vega is just one of our many case studies. Our data-driven approach combines:

- Brand strategy rooted in real consumer insights

- Designing and packaging that is distinctive, conversion-driven, and future-proof

- Consumer testing to validate what works in-market

Book a call today, and let’s future-proof your brand before your competitors do.

Subscribe to

Nice Package.

A monthly newsletter that unpacks a critical topic in the FMCG & CPG industry.

Free Resource.

CPG product repositioning guide.

Explore the five undeniable signs your CPG product needs repositioning along with strategies for leveraging consumer insights for a guaranteed market lift.

Learn More About CPG product repositioning guide.