Most CPG brands are sitting on a goldmine of untapped potential. The problem? They’re flying blind. Packaging, pricing, positioning—every decision hinges on consumer behavior, yet too many brands rely on gut instinct rather than cold, hard CPG insights. The result? Missed opportunities, underwhelming sales, and a constant battle to stay relevant in an unforgiving marketplace.

This is where CPG insights become game-changers. By harnessing CPG data analytics, brands can unlock the patterns that drive purchase decisions, identify white-space opportunities, and predict market trends before they happen. Consumer insights are no longer a luxury—they’re the difference between dominating the shelf and disappearing.

This guide will discuss how CPG companies can leverage CPG data analytics to turn insights into action. From real-world examples to practical strategies, we’ll discuss how CPG brands can sharpen their competitive edge, optimize product performance, and drive lasting growth.

Existing CPG data analytics.

Looking at historical data is a start—but stopping there is a mistake. A 30,000-foot view of retailer trends, category shifts, and audience behavior can give CPG brands a snapshot of what’s happening, but snapshots don’t drive CPG growth. Real impact comes from digging into CPG data insights that reveal not just what’s happening but why—and how to act on it.

To fuel CPG brand growth, we pull three critical CPG consumer insights levers, using CPG analytics to pinpoint the factors driving purchase decisions. These aren’t just numbers on a spreadsheet—they’re the foundation for an informed, results-driven strategy that gives brands the edge they need to win.

Observational data.

Sometimes, the most powerful CPG insights come from simply paying attention. Whether through hands-on research or leveraging CPG panel data and POS data from industry sources, observation is crucial in shaping a winning CPG growth strategy. Understanding how consumers interact with CPG products at retail, what influences their decisions, and where gaps exist in the market gives brands the needed edge.

The right CPG data insight makes all the difference for any CPG company looking to drive revenue growth. Today’s CPG firms and organizations can access robust tools like an insights dashboard to track real-time trends. From simple field research to advanced analytics, unlocking retail insights starts with knowing where to look and how to act on what you find.

| In-store observations | Researchers or analysts observe consumers in physical retail locations, noting their product preferences, behaviors, and interactions with CPG products. |

| Online observations | Observational data can be collected through digital channels like ecommerce websites or social media platforms. Researchers may analyze user behavior, browsing patterns, and product reviews to gain insights into consumer preferences and usage. |

| Usage monitoring | Some CPG products, such as smart appliances or connected devices, may have built-in sensors or monitoring capabilities. This allows companies to gather data on how consumers use the products, which features are most popular, and potential areas for improvement. |

| Panel studies | Observational data can be collected through panels of consumers who agree to provide information about their product usage, purchasing habits, and experiences over a specific period. Researchers can then analyze this data to identify trends and patterns. |

Activity data.

Every step a product takes through the supply chain generates retail data—from distributors to store shelves to the final purchase. CPG marketers who know how to harness this information gain a decisive advantage. Data providers collect and resell this information, often layering in customer insights and key trends uncovered in the process.

For brands focused on CPG marketing and optimizing the customer experience, this data unlocks actionable insights that drive more intelligent decisions. From pricing strategies to shelf placement, every detail matters. The correct data isn’t just numbers—it’s a roadmap to winning at retail. Here’s what CPG brands can tap into to sharpen their strategy.

| Sales and transaction data | This includes data on product sales, revenue, units sold, and transaction details. It helps track the performance of specific products, brands, or categories. |

| Promotional and marketing data | This data captures information about promotional campaigns, marketing activities, and advertising efforts. It includes metrics such as the number of coupons redeemed, promotional discounts applied, advertising reach and engagement, and customer response to marketing initiatives. |

| Trade and distribution data | Activity data can encompass information about the distribution and supply chain activities. It may include data on the number of retail stores carrying the products, stock levels, inventory turnover, and distribution network performance. |

| Customer engagement and loyalty data | This data focuses on customer interactions and engagement with CPG products. It may include metrics such as customer reviews and ratings, loyalty program participation, social media engagement, and customer satisfaction scores. |

Sales data.

For CPG brands, every transaction is a goldmine of customer insight—if you know how to use it. Purchase data isn’t just about tracking what’s selling; it’s about understanding why. Innovative brands leverage Google Analytics and other data sources to optimize their supply chain, boost per-store performance, and strengthen customer loyalty.

In a world of digital transformation, sales data fuels everything from product development to pricing strategies. It directly impacts gross margin and ensures brands make informed decisions that drive sustainable growth. Here are the key data points every brand should analyze to stay ahead.

| Seasonal Demand | Analyzing sales data helps identify seasonal trends and consumer preferences, optimizing production, inventory, and marketing campaigns. |

| Product Performance | Sales data evaluate individual products or categories, identifying best-sellers and areas for growth or improvement. |

| Pricing Strategies | Analyzing sales data alongside pricing information reveals consumer response, helping adjust prices for profitability and assess the impact of different strategies. |

| Market Share Analysis | Sales data compare market share with competitors, guiding strategies to increase market presence and target specific segments. |

| Channel Effectiveness | Categorized sales data to assess channel performance, optimize distribution strategies, and identify expansion opportunities. |

| Regional Preferences | Segmenting sales data by region uncovers preferences, allowing targeted marketing, product localization, and regional expansion planning. |

| New Product Launch Performance | Sales data assess the success of new product launches, enabling adjustments to marketing strategies and product improvements. |

| 1st Party Website Data | Analyzing data from a company’s website provides insights into customer behavior, preferences, and engagement. |

Creating CPG data analytics.

While existing data creates the foundation for the strategy, many questions remain unanswered. To answer these questions, brands can create new data through consumer research and brand testing.

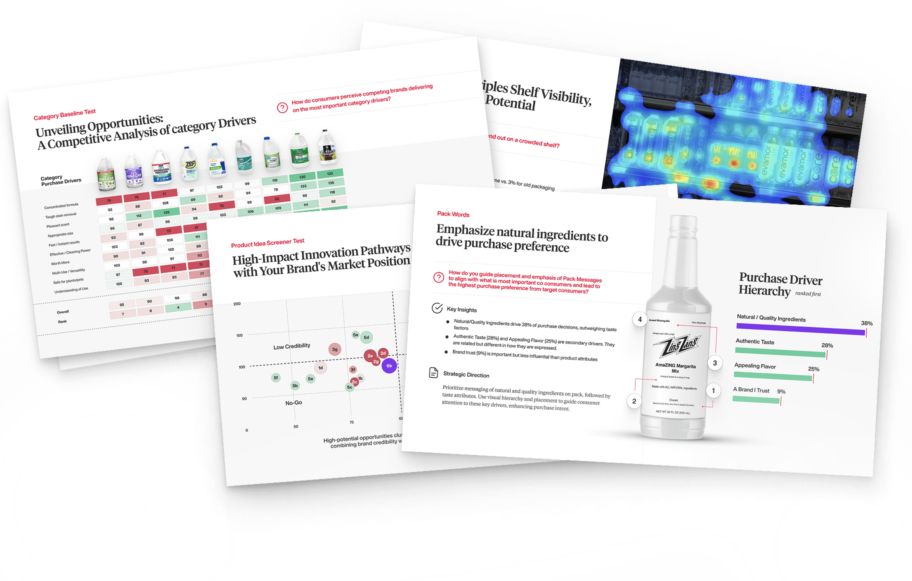

Through consumer research, individuals or groups within the target audience are placed in immersive environments to understand how changes influence purchase decisions. Here are some of the services we offer our clients at SmashBrand.

| Competitive Perception Testing | Consumer Habits & Attitudes |

| Brand Resonance Testing | PackWords™ Message Testing |

| Concept Diagnosis Testing | Purchase Intent Testing |

An agency conducts these tests to gain a greater understanding of the brand. They determine each CPG branding element that impacts memorability and brand loyalty. The bottom column represents package design testing, which is critically important in the CPG industry as the retail shelf is closest to the point of purchase.

Our process unveils winning designs in a blink.

We discover the most effective concepts for your packaging design strategy by employing our proprietary Gut Check Testing™ – a swift, perception-based diagnostic designed to evaluate a broad spectrum of concepts and pinpoint the ones that resonate most with consumers.

Pricing strategy.

Price sensitivity testing is one of the most valuable tests for CPG products. How a brand prices its product directly impacts consumer preference. Testing helps the CPG brand understand the highest price it can receive for the current level of value the consumer perceives the product to have.

Opportunities for CPG brands.

Now that we have a baseline of historical and researched insights into CPG brands let’s examine real-time opportunities based on what consumers are currently attracted to.

Brand collaborations.

There has been an uptick in brand collaborations, but given how powerful this CPG brand strategy is, opportunities remain for brands willing to put forth the effort. Big and small brands can collaborate to reawaken their existing audience and capture new consumers through brand collaborations.

Limited-time promotions.

Static, unchanged product lineups and pricing models only work for brands with a giant moat and massive market share. We’re talking about brands such as Nestle and Unilever. Unless you are one of these giants, offering limited-time promotions through product drops or pricing models.

These strategies tap into the psychology of scarcity, one of the best ways to convince consumers to “act now” before being interrupted by other brands vying for their attention. In today’s world, promotions are a necessary part of an activation strategy for any brand seeking growth.

Product personalization.

There has never been a more critical time to personalize the product experience by tailoring messaging and branding to a specific target audience. The approach to achieving this varies for each brand category and product positioning, but it remains essential for consumer packaged goods (CPG) brands.

CPG trends.

Brands should proceed cautiously when considering the latest CPG trends as valuable insights for their product. Emerging trends speak differently to each category, some of which are like a match that lights quickly but only lasts a short time.

Chasing consumer trends isn’t the best idea for CPG brands unless it naturally flows through your brand theme. Trying to put your square brand into a round trend is a noticeable misalignment by the consumer that will cost you street cred and revenues.

The role of AI in CPG insights.

We’ve mentioned many strategies for identifying insights, but how do you bring these together into actions your brand can take? And once you have those actions, how can you implement them into your CPG business? Here’s how.

Machine learning for data understanding.

The rise of omnichannel CPG has driven the development of machine learning tools that turn each data point into actionable insight. This process delivers unique channel, category, and competitor trends that improve your optics for better decision-making. Combining these data points establishes predictive analytics for consumer insights with the most excellent chance of moving the needle for your brand.

Generative AI for content distribution.

Natural language processing is lighter fluid on a CPG brand’s marketing department. The consumer requires significantly more touchpoints before purchasing as compared to previous years. Any product launch, promotion, or new media enthusiasm can be leveraged with generative AI, such as ChatGPT, to create press releases, white papers, and social media content. These tools are a marketer’s dream come true.

Path to Performance™

Taking a results-obsessed approach to CPG package design.

Learn how SmashBrand’s proprietary process – rooted in scientific principles, informed by data, and validated by your target audience – takes the guesswork out of package design and delivers guaranteed results.

How to approach CPG insights for your brand.

Your brand doesn’t need to chase every CPG data insight—just the right ones. While advanced CPG analytics may be a luxury for big-budget brands, integrating data into your strategy isn’t optional. Every CPG company can use consumer insights to guide their next move, ensuring each decision is smarter, sharper, and built for growth.

Strategy.

What consumer insights around the competitive landscape and behavior can you take advantage of as you develop your product? For small brands, perform competitive audits where you thoroughly review the competitor set in each sales channel. Then, use free or low-cost services such as Byzzer to start your journey on the CPG market research path.

Go-to-market.

Retailer confidence is a critical component of retail execution. You can no longer establish relationships with national retailers without the support of data demonstrating your product’s market potential, consumer demand, and competitive advantage. For new brands, you must create data that tells a story.

Presenting data to the retail buyer makes the decision-making process smoother. When the data looks promising, it gives your brand better positioning in the store, where more eyeballs will see your product. The success or failure of your marketing efforts hinges on your ability to persuade the retailer about your brand’s potential.

Presenting consumer insights might sound like an unavailable tool for emerging brands, but there’s plenty to report on. Leverage insights such as your ability to fill a competitive gap where there is demand alongside first-party data from your ecommerce website to seal the deal.

Activation.

Many CPG insights shape strong marketing campaigns, but once your product hits the shelves, a new opportunity emerges—one most brands ignore. Personalized in-store advertising strengthens your relationship with retailers and unlocks customer analytics that drives smarter future decisions.

Yet, too few brands leverage the CPG data insights gained from these campaigns. The result? missed opportunities to refine targeting, optimize promotions, and maximize impact where it matters most—at the point of purchase. It’s time to change that.

Nice Package

Don’t miss out on our monthly newsletter Nice Package!

Each month, we deliver a data-driven newsletter directly to your inbox, unpacking a critical topic in the FMCG & CPG industry.

"*" indicates required fields

An insight to remember.

Data-driven insights are the way a brand succeeds in this world. Test every idea to validate its potential in the marketplace. If you wish to grow your brand, you must invest in identifying insights and regularly report on the data you receive as your product lives in the market.

Data-driven brand development for CPG brands.

If you are looking for an agency to help you define and execute a new positioning that attracts more potential customers, we can help. SmashBrand is a brand development agency for CPG brands. Our PathToPerformance™ process guarantees a performance lift.

Subscribe to

Nice Package.

A monthly newsletter that unpacks a critical topic in the FMCG & CPG industry.

Free Resource.

CPG product repositioning guide.

Explore the five undeniable signs your CPG product needs repositioning along with strategies for leveraging consumer insights for a guaranteed market lift.

Learn More About CPG product repositioning guide.